International Offshore Bonds – Beware

Unwary expats are targeted by commission only salespeople, who recommend expensive bonds for the commission they pay them rather than if it the best investment vehicle. Investments perform with lower charges normally.

10 Golden rules for expatriate investment

We re-invest all investment commissions so you can benefit from greater growth.

Below you will find 10 points you should be aware of as an expat, brought to you from expat experts. If you wish to be worry-free or stress less then by following this points you could avoid charges and risk.

This article, combined with our BLOGS, has saved some clients tens of thousands of pounds so 10 minutes of your time now will be worth it.

Anyone reading to the end, who is thinking of making an investment (or take advice on your pension or lump sum) then there follows 10 critical points to ensure you make a better investment or pension choice (whether it be QROPS or SIPP) and it will also help you avoid perhaps making a huge mistake.

Rule No 1: Do not believe everything you are promised overseas

This is particularly true for offshore investors. Putting it bluntly there are many regions of the world both with and without regulation, that have no enforcement. Putting it even blunter, if there is no enforcement then there is a really high propensity for you, the client, to be ripped off! So, just having regulation is meaningless with it being backed up.

Cross border regulation also fails in many instances, so unless you live in the UK, Australia, France, the USA or a properly regulated and enforced territory then you will have no come back, no matter what “terms of business” you have signed.

Rule No 2: You need a clear realistic target

When I talk to clients they often say they have low, medium or high risk without, in any way, understanding the correlation between this and the return they want. This in turn may have no correlation to actually what they need to achieve to meet their targets.

Expat pension advisers, in the main, simply agree with whatever return you are seeking and correlate it to the same risk you are stating you are. “No problem, I can obtain a 10% return for you with low risk”. As investment and pension expat experts we will cover this point in more detail later on!

Rule No 3: Understand risk as it applies to you

Risk is not the same as probability. I have run seminars first in the UK, and then latterly in Europe for 14 years, and I always ask this question,

“Which of the following is more or less risky? Investment A has a 95% chance of doubling in value, and Investment B has a 70% chance of increasing by 50%.”

Many people, without further prompting will quickly surmise that Investment A is less risky and has higher reward – this is exactly how salesman offshore sell investments with higher potential returns, so please note how significant “greed” can be when looking at returns.

However, if you now apply an investment on this basis and say that the upside and downside are equal (e.g. if it can go up 50%, then it can go down 50%) then consider the following scenario.

You will take a loan against the total value of your house and invest that in Investment A, as against investing this month’s spare income, say £1.000, into Investment B. Now look at outcomes below and tell me which is less risky:

- Best scenario for Investment A, is that you have a 95% chance of doubling the value of your home, but a 5% chance you will lose 100% of your home , or

- Best scenario for Investment B, is that you have a 70% chance of increasing your investment to £1,500, but a 30% chance of losing £500.

If you still think probability is tied to risk, or if you do not know the answer to this by the way, then now is the time for me to respectively suggest you should not be investing your money, and ask someone else to assist you!

Rule No 4: Keep abreast of the big picture

Investing is down to understanding what is going on in the global world nowadays. If banks in China do not look good to invest in, then understand they are probably being lent money by governments and other banks from outside China.

The attitude of many “in the west” that Chinese banks are far away and will not affect them should be reconsidered. Keep an eye out for major events like governments withdrawing funding (QE as we now call it, or budget deficits) from economies, as this really effects banks, and therefore companies, and therefore employment levels, consumer spending power, economic growth, your investments, your planning and your retirement, and so on and so forth.

Rule No 5: Keep abreast of new ideas

The best investment I ever made was in a small British company called PSION in the early 1990’s. I knew nothing about investing back then, but I noticed that all my friends were buying the PSION 5, the first little touch screen mobile organiser. I bought one as well, realised it was the future, and so went and bought a few thousand PSION shares. My memory dips on dates at this point, but I made about 12 times what I originally invested, and used the money to put an extension on my house (all before I became a professional adviser I hasten to add).

As an adviser, and keeping in check Rule No 3, please note that I could have lost all my money if things had not turned out so well, and I would not actually advise anyone nowadays to put their money in one single share, but the point is still made – keep an eye out on what people are buying around you and the latest trends. It does not always work but at least it gives you some pointers.

If you combine Rule number 4 and 5 together then you start to build both a strategy and how/where you wish to invest.

Rule No 6: Focus on dividend reinvestment

Dividend reinvestment is the key to superior long-term returns. In Shares magazine 15 May 2014, they published some tables and this part of this article is taken from their calculations:

Shares wrote that “Based on the UK equity market’s historic 30-year compound average capital gain of 7% and 3.6% dividend yield our example shows how £1,000 could be worth £20,767 in nominal terms three decades on, if dividends are harvested and reinvested as the UK market matches its historic return profile.”

Shares then goes onto write, “£1,000 would become only £7,655 nominal over 30 years if you banked the capital gain alone and took no dividend yield at all. The £20,767 figure is based on reinvesting net dividends, the actual amount paid by the firm after HM Revenue & Customs retains its 10% slice via the dividend tax credit.”

The conclusion is simple and accurate, “Dividend reinvestment unlocks the long-term potential of equities.”

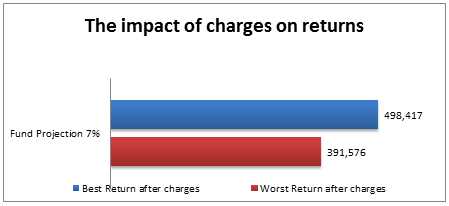

Rule No 7: Minimise ongoing costs

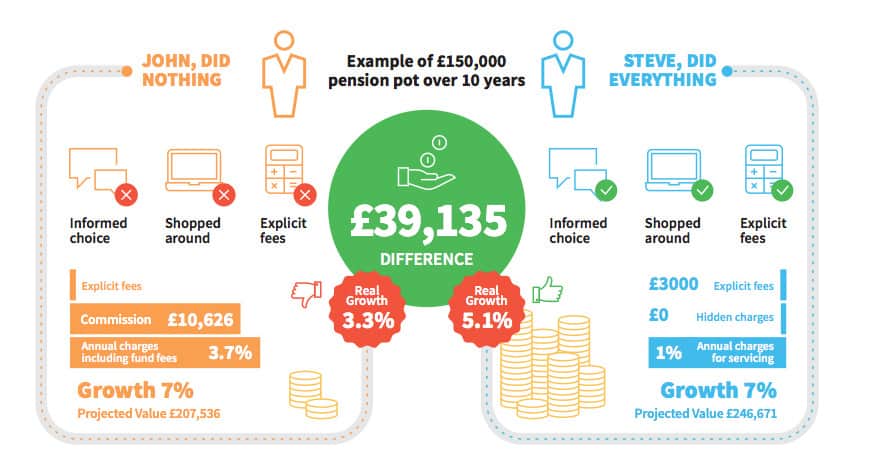

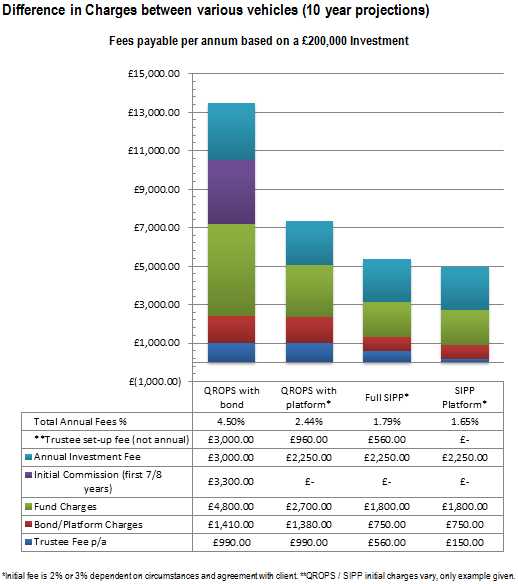

This sort of sits with our first rule, Rule No 1. Unscrupulous overseas advisers acting in countries where there is no enforcement, who claim to be expat experts or pension experts or offshore investment expat experts, will sell you bonds, bonds in bonds, bonds in pensions, bonds for holding lump sums, and bonds for long term pension planning and bonds for 5 year investment terms. You will be sold a bond because they are (Tick the boxes off as applies) tax efficient, cheap (only 1% charges advertised), come with investment protection, and “free” (you do not have to pay the adviser for advice). They also provide “gross roll up” and provide “tax free income” up to 5% per annum and sometimes higher.

I can only say, that if all that were true, then I am sure you would expect that in the UK and US, collectives and insurance / investment bond wrappers would be the only investments sold.

Except, they are not, In fact, since “explicit fees” have been introduced in places like the UK ( i.e. you have to be told exactly what you are paying for every element of an investment, not just advice) then investment and insurance bond sales have gone down dramatically as well as some collectives. Why?

We will write a blog about it, but safe to say that fat sales commissions and hidden opaque charges play a big hand in it!

Oh, and as for all those benefits, the tax efficient, investment protection, “free” advice, “gross roll up”, “tax free income” they are often offset by the high charges you are paying, and in the worst case they are purely illusionary as not every country recognises bonds. Just to be clear, if you are in the US or Australia and you hold your money in a bond, whether it be in a QROPS or directly, then I would strongly suggest you take some tax advice, as you might be heading for a really big tax bill!

For now, just trust me and avoid insurance and investment bonds written on full commission as their “advantages” are massively outweighed by their “disadvantages” in many cases.

To minimise costs, the Rule No 7, is go to an adviser with explicit fees, and no hidden commissions, who rebates all the commission back into the bond or custodian WRAP.

Rule No 8: Know your limits and diversify

If you are not able or prepared to do the research you will get yourself into a lot of problems very quickly. Enough said really.

As we made the point in Rule No 3, in order to lower your risk exposure, do not work on probability but instead work on diversifying your investments into different asset classes. You are less likely to perform as well as equity markets when they are going up (you will underperform, as you will obtain an average return from all asset classes and some will do well and some will do poorly), but you will also not perform as badly when equity markets go down (assuming that you have not just invested in different shares in the same market of course).

Rule No 9: Active fund mangers rarely or consistently outperform passive trackers

However, you do not want them to. If they do, then they are taking more risk than a tracker, and that would be a lot of risk. For every star hedge fund manager you read about, there are many more who lose all their clients’ money. Just remember, hedging is two way.

For every winner there has to be a loser. There is one caveat on this saying; if the fund manager is earning each time a trade is placed, then no matter what happens he/she will be a winner.

Like so many things it all comes down to risk again, and as in RULE NUMBER 1, if there are no consequences to the individual making the investments, then do not be surprised if you lose money!

Rule No 9 says, you should invest in portfolios that include passive trackers, and you should invest through an adviser who is getting paid on the basis of fund values.

If it hurts me, just as much as you, if your fund goes down, I will want to ensure that does not happen (although in 2002 and 2008/9 there was little I could do to prevent it as all asset classes went down at the same time, and in 2009 also cash was high risk due to banks failing!)

Rule No 10: Go against the herd

The best advice comes last. Of course, it slightly contradicts what I wrote in RULE NUMBER 5. If the herd are all buying the same share that you hold, then stay with the herd as they are following you! So the rather glib comment “go against the herd” is really trying to state, do not follow everyone else just because they are all doing the same thing, unless it suits you.

Use the pack mentality to assist you. Humans are gregarious and we work in packs. We are like cows, and the lead cow often has a bell, which the others follow. Well investing is the same. The cow with the bell are newspaper stories, fund house recommendations, economic opinion formers, etc. If you only listen to the bell then do not be surprised if you are at the rear of the herd of cattle having to walk over their excreta. Yep, sorry to put it this way, but you are always going to be following someone else’s bottom, and we cannot control what comes out of other people’s bottoms.

Summary

Apologies to all tree lovers, but print it off and take it to the toilet with you.

These ten rules of investment will help you make the right decisions as an offshore expat. They are not limited to purely investing, as they also consider products and what advice you might be receiving.

- Spotting quality investments is not easy, buying them at a respectable valuation harder still, but the rewards can be great for the patient investor who manages both feats.

- The very best investment advice works because it is simple. Stick with what you understand, and understand the consequences of loss; in other words do not risk everything if you cannot afford to lose it. This is vital when it comes to putting capital at risk in the financial markets. So, be brave, do your research, follow the 10 rules above, and do not be swayed by other people – do your own thing!

May we suggest, if you have found this useful, that you send it on to someone else about to take offshore advice.

Contact us now ›

SIPPs

There are many benefits of a UK Self Invested Personal Pension scheme…

Read more

QROPs

There are many benefits that a Qualifying Recognised Overseas Pension Scheme…

Read more

QNUPs

Qualifying Non UK Pension Scheme are actually a natural progression…

Read more

Tax free cash benefits

Plan how to best take your benefits from your pension…

Read more

Download your

Free Guide

to Investing

How we can help you

Would you prefer UK qualified experts to provide competent advice, rather than an offshore salesman seeking commission?

Are you no longer resident in the UK or considering moving abroad?

Do you have more than £50k in your UK pensions?

Would you like to pay less tax and have greater investment freedom?