Award-winning advisers take on QROPS

We know you want a video about QNUPS – it’s coming, but for now, be aware of QROPS which are like QNUPS – a niche market for those with larger pension funds where there is a risk of a Lifetime Allowance.

QNUPS Explained | Compared To QROPS | In Relation To HMRC

Qualifying Non UK Pension Scheme (QNUPS) are actually a natural progression on from QROPS for those who wish to increase their investment options, but they benefit wealthy individuals irrespective of where they live. A QNUPS can invest in practically anything, even a residential property at the moment. Therefore, your pension fund can suddenly change from being a staid old UK based pension into a life-changing asset that can be utilised in multiple ways.

Key benefits

One of the key benefits is the ability to purchase residential or commercial property. This allows your pension fund to purchase a property for you to either live in or let out.

Another benefit is for high earners who are unable to make fully tax relieved pension contributions in the UK due to recent legislative changes. QNUPS, we believe, will become a very attractive option for wealthier clients, as you can save large sums of money for your retirement without the constraints of UK pension legislation.

What is a QNUPS?

QNUPS stands for Qualifying Non UK Pension Scheme, designed for pensions and income being taken outside the UK. However, they can also be utilised by UK residents, as QNUPS are an efficient means of avoiding inheritance tax (IHT) legally.

When it comes to QNUPS, HMRC have specific criteria for overseas pensions for them to be designated as “qualifying”, and thus not attract IHT. For example, schemes must be based overseas and, critically, need to be not in countries that have signed Double Taxation Agreements with the United Kingdom.

Our team of expert pension advisers can explain whether a QNUPS is the right option for you, and explain the situation with QNUPS and HMRC.

What is a ROPS?

Recognised Overseas Pension Schemes are essentially the same as QNUPS, in that they also apply to UK residents as an efficient means of avoiding inheritance tax (IHT) legally. They can also be used in other ways by expats in the UK, who wish to one day leave the UK and take their pension earnings with them to their home country without the tax burdens of the UK schemes. However, there are no tax breaks on putting money into ROPS.

Expert Advice

Our Pensions advisers are the leaders in QNUPS advice, giving you the very best advice and information wherever you are in the world.

The Pensions for Expats team can find you the most suitable, cost-effective and efficient QNUPS solution available. We complete all the work from start to finish, removing the hassle & paper work. With our commitment to our clients, we ensure we give the very best independent advice.

Qualifying criteria for a QNUPS:

| Holds UK assets worth at least £650k |  |

| Has separate pension plans in place |  |

| High net worth individual who requires planning |  |

| Requires assistance with IHT for family |  |

| Lives in the UK, and UK pension has not been fully funded |  |

| Desire to invest in property or company shares |  |

| Holds company/occupational pension already in drawdown |  |

| Still a UK resident with no intention of moving overseas |  |

Independent Advice

We are completely independent meaning we are not linked to any one QNUPS scheme, therefore we can advise on all QNUPS providers around the world. Our recommendation is based upon our extensive experience with QNUPS, knowledge of all QNUPS providers and QNUPS schemes, on-going research of new QNUPS solutions & identifying our client’s needs. We provide you with complete independent unbiased advice.

AVOID HUGE COMMISSIONS: We will conduct business at minimal cost to you

Contrary to how most overseas expat advisers operate, we work exclusively on a transparent fee-based model, and do NOT charge any commissions. Click for more information on who we are and how we charge › and comparing Fees versus Commissions ›

Widely available

QNUPS do not have to be situated in countries that have signed a DTA (Double Taxation Agreement) with the United Kingdom.

No maximum limit for contributions or age

As QNUPS do not benefit from tax breaks on the “way in”, it means there is no maximum lifetime contributions limit. This can be a huge benefit for IHT planning.

With QNUPS, you can contribute to your scheme as long as you want to at any age. Normal pension schemes only offer tax relief and exemptions for money earned in employment. QNUPS permit contributions from assets you have acquired in any way and again there are no limits, although once the money is invested in the QNUPS fund then it follows UK pension rules for access and taxation.

Non-resident and resident members

Depending on the rules of the individual scheme, QNUPS may be available to UK non-resident members. However, the IHT exempt status may not be lost if you decide to return to the United Kingdom within 5 years (compared to a QROPS).

Growth is free from taxes including CGT

The assets in QNUPS can grow free from CGT, which means that your family can eventually benefit from the capital growth of your QNUPS assets in full when they inherit them. However, please note that any assets moved into the QNUPS will have to be sold and bought leading to tax liability in your resident country at that point on both potential CGT, income and corporation tax depending on the asset.

Contact us now ›

SIPPs

There are many benefits of a UK Self Invested Personal Pension scheme…

Read more

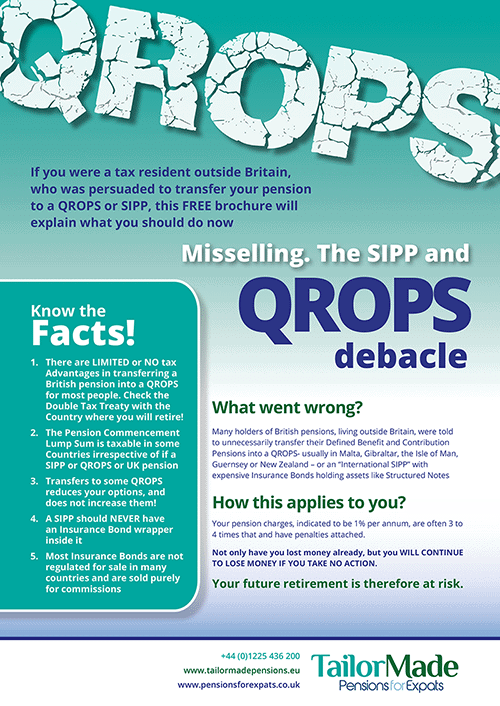

QROPS

There are many benefits that a Qualifying Recognised Overseas Pension Scheme…

Read more

QNUPS

Qualifying Non UK Pension Scheme are actually a natural progression…

Read more

Tax free cash benefits

Plan how to best take your benefits from your pension…

Read more

Download your

Free Guide

to Investing

How we can help you

Would you prefer UK qualified experts to provide competent advice, rather than an offshore salesman seeking commission?

Are you no longer resident in the UK or considering moving abroad?

Do you have more than £50k in your UK pensions?

Would you like to pay less tax and have greater investment freedom?